What’s in the One Big Beautiful Bill?

A Simple Breakdown for Everyday Americans

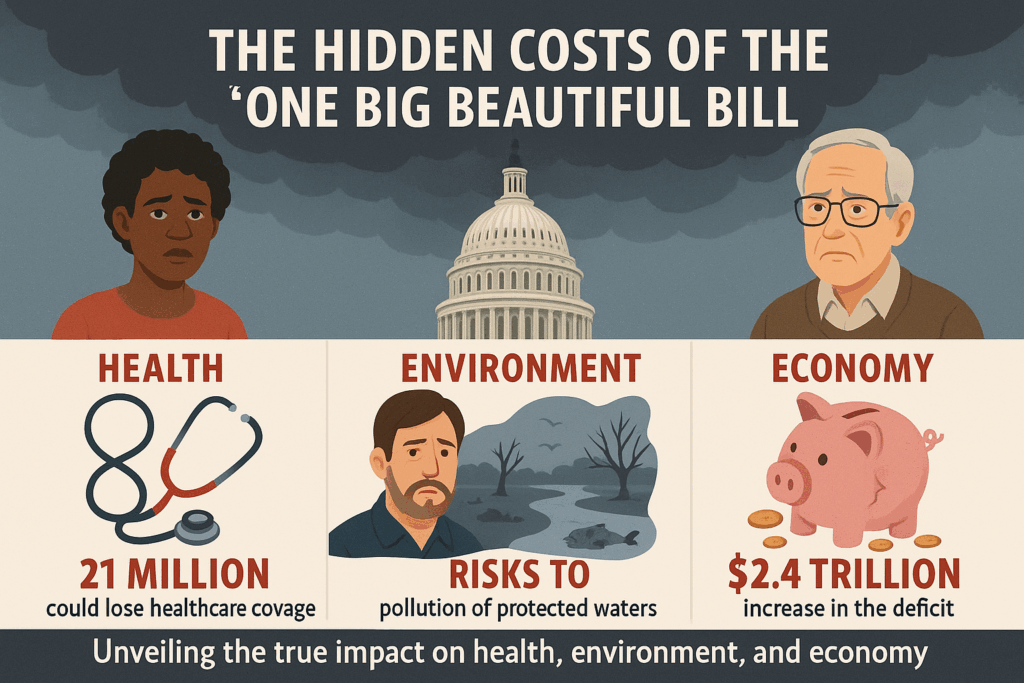

The “One Big Beautiful Bill Act” (OBBBA), backed by former President Trump, is a sweeping proposal that bundles together tax cuts, welfare reforms, defense spending, and regulatory rollbacks into one massive bill. It’s passed the House and now heads to the Senate.

Here’s what it includes — and why many are worried.

💰 Tax Reforms

What’s proposed:

Permanent extension of 2017 Trump tax cuts

Eliminates federal income taxes on tips and overtime pay for those earning under $160K

Increases the SALT deduction cap for high earners

Expands the Child Tax Credit from $2,000 to $2,500 until 2028

Creates “MAGA Savings Accounts” with $1,000 in annual child deposits

Concerns & Impact:

While lower-income workers may see minor tax relief, wealthier individuals and businesses benefit the most

Could add $2.6 trillion to the national debt over 10 years

Critics say the bill increases inequality and doesn’t do enough to help working-class families long-term

🏥 Health & Social Programs

What’s proposed:

Adds strict work requirements for Medicaid and SNAP (food stamps) recipients

Forces states to cover more costs of food aid (up to $2.1B for NY alone)

Adds penalties for states with high SNAP error rates

Concerns & Impact:

Could cause millions to lose access to Medicaid and food stamps (SNAP)

Single parents and older workers could be forced out of programs if they can’t meet work-hour rules

Places massive financial pressure on states, especially during economic downturns

May increase child hunger and health issues among vulnerable families

🏡 Defense & Border Security

What’s proposed:

$150B boost to defense (new drones, AI tech, cybersecurity)

$70B to border security (wall building, more agents, surveillance tech)

Concerns & Impact:

Critics argue the bill over-prioritizes military and border expansion while cutting basic needs like food and health care

Funds wall construction that many see as ineffective and divisive

Defense contractors stand to gain more than average Americans

🌿 Environmental & Regulatory Rollbacks

What’s proposed:

Rolls back clean energy tax credits

Imposes a 10-year ban on state-level regulation of artificial intelligence

Limits federal courts from enforcing contempt orders unless plaintiffs pay up front

Concerns & Impact:

Undermines the Inflation Reduction Act’s climate progress

Could slow clean energy development and worsen climate risks

Hands more power to corporations developing AI, limiting local regulation or consumer protection

Weakens judicial oversight, making it harder to hold officials or corporations accountable

📊 Fiscal Consequences

What’s proposed:

Massive tax cuts paired with increased defense spending

Minimal offsets or revenue generation

Concerns & Impact:

Adds $2.6 trillion to national debt

Moody’s downgraded the U.S. credit outlook over concerns of unsustainable fiscal policy

Could lead to higher interest rates, inflation, or cuts to future services

🧑🤝🧑 Political Reactions

Supporters say:

It’s pro-growth, pro-family, pro-worker, and will “make America strong again.”

Critics say:

It’s a “reverse Robin Hood” — giving to the rich, taking from the poor.

Even some Republicans are voicing concern over its cost and impact on the vulnerable.

⏳ What Happens Next?

The Senate will debate and vote — possibly by July 4, 2025. If you care about the future of social services, taxes, or the environment, now’s the time to speak out.

📢 Take Action:

You can contact your Senators at www.senate.gov/senators to voice support or opposition.